24-Hour Grace®

At Huntington, we're for people. That's why our 24-Hour Grace feature gives you more time to deposit funds in your account to avoid being charged overdraft fees, and also allows you to take action to get your pending return transactions paid. It's free with all Huntington accounts##.

We want to help you avoid overdrafts and returns, so having a clearer understanding of them is a good place to start. Learn more about overdrafts and returns.

How to avoid overdraft fees and returns with 24-Hour Grace

With 24-Hour Grace, you need to make a deposit that meets the following criteria:

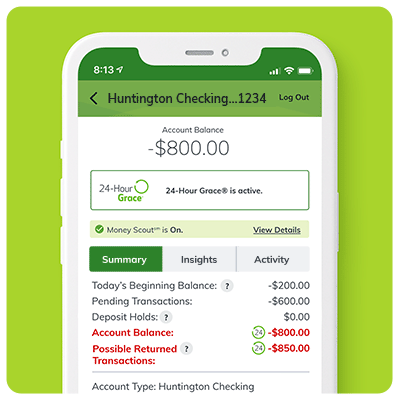

See 24-Hour Grace in the Huntington Mobile app

An in-app message will appear at the top of your Summary screen, letting you know when 24-Hour Grace is active.

If your account is overdrawn, your account balance will turn red and the 24-Hour Grace icon will appear. Overdrafts are reflected in your account balance.

Returns will appear below your account balance in the "Possible Returned Transactions" line.

In this example, $1,650 plus the additional amount needed to cover transactions that might post that day would need to be deposited to pay the transactions and avoid any overdraft fees. You may also incur fees from the merchant if your transaction is returned.

We make overdraft fees avoidable.

With our $50 Safety Zone®, there is no fee if your account is overdrawn by $50 or less.##

24-Hour Grace overdraft and return fee relief is for Business too.

At Huntington, we're for small business. That's why our unique overdraft and return fee relief is included with all Huntington Business Checking, Savings, and Money Market deposit accounts.

What else can you do?

The best way to protect yourself from overdraft fees and returns is to know your balance and keep it positive. We know accidents happen, so here are three more things you can do:

Know your Options

Link your Accounts

Get the Tools

Get more time, not more fees.

24-Hour Grace FAQ

Answer: When you do not have enough money in your account, the bank decides whether it will pay or return an item based on your overdraft elections.

An overdraft occurs when you don't have enough money in your account to cover a transaction and the bank pays it. Examples are overdrafts caused by check, in-person withdrawal, debit card purchase, ATM withdrawal, or other electronic means.

A return occurs when you don’t have enough money in your account to cover a transaction and the bank does not pay it. Examples of returns include checks and electronic paymentsⱢ.

Answer: 24-Hour Grace: Overdrafts

We will not charge an overdraft fee unless your account is overdrawn by more than $50. When your account is overdrawn by more than $50, 24-Hour Grace gives you more time to make a deposit and avoid overdraft fees. Just make a deposit or transfer that brings your account to a positive balance, before midnight Central Time on the next business day.

We understand that overdrafts happen. If you are enrolled in Standby Cash, you can access your Standby Cash credit line for help. If you believe you're going to overdraw your account, you can use Standby Cash and make a transfer to prevent the overdraft from occurring.†

Example:Let’s say you start the day with $50 in your account and spend $150 at the grocery store, your account balance is now -$100. With 24-Hour Grace, we give you until midnight Central Time on the next business day to make a deposit or transfer and avoid overdraft fees.

Make a deposit or transfer that brings your account to a positive balance, including new transactions that are being processed that day, and we’ll waive the overdraft fees.

24-Hour Grace: ReturnsIf you forgot about a check you wrote, or an automatic payment that was scheduled to debit your account, and you don’t have enough funds in your account, 24-Hour Grace gives you more time to make a deposit to cover any transactions that we would have returned unpaid. Just make a deposit or transfer to bring your account balance positive, including new transactions from that day (such as debit card transactions, written checks, and scheduled automatic payments) plus the total amount of possible return transactions before midnight Central Time of the next business day. If not, the transactions will be returned unpaid, and you may incur fees from the merchant.

We understand that overdrafts happen. If you are enrolled in Standby Cash, you can access your Standby Cash credit line for help. If you believe you're going to overdraw your account, you can use Standby Cash and make a transfer to prevent the overdraft from occurring.†

Example:You have $50 in your account when your $1,500 mortgage is scheduled to auto-pay that day. If we decide not to pay that into overdraft, we’ll give you more time to make a deposit and have your mortgage paid with 24-Hour Grace.

Make a deposit or transfer that covers the total amount of your possible return transactions, plus any new transactions that are being processed that day, and we'll pay your transaction.

Answer: 24-Hour Grace applies to the following transactions:

a. Overdrafts—Huntington pays a transaction when you don’t have enough money in your account.

b. Returns—Huntington does not pay a check or electronic (ACH) payment when you don’t have enough money in your account. Not all returns may be eligible for 24-Hour Grace.

Answer: It’s the bank’s decision whether to make these payments eligible for 24-Hour Grace. Generally, this decision depends on multiple factors related to your banking relationship.

Answer: Check and automatic (ACH) payments not eligible for 24-Hour Grace will not be paid even if you make a deposit to cover these items the next business day. You may incur fees from the merchant if your items are returned.

Answer: Customers enrolled in Huntington Heads Up® alerts§ will receive an email (and/or a text message or push alert) on the morning that they need to make a deposit for 24-Hour Grace. These alerts will let you know whether you have overdraft transactions, possible returned transaction eligible for 24-Hour Grace, or returns not eligible for 24-Hour Grace that you need to address. Additionally, online banking customers will see a notification in their online or mobile Account Details if they are in 24-Hour Grace and a summary of the possible returned transactions.

Answer: These alerts§ and messages are scheduled for delivery the morning of the same business day you need to make a deposit to take advantage of 24-Hour Grace.

Answer: To take advantage of 24-Hour Grace for overdraft fee relief, you must give us permission to overdraw your account (opt-in for overdraft options). However, you do not have to opt in for overdraft options to use 24-Hour Grace to avoid returns and have your possible returns paid.

Answer: We offer several self-service channels to check your account balance: online and mobile banking, text, and email alerts§, and through our ATMs and telephone banking service.

Answer: You need to check your account balance, but that’s not all. Transactions come to us from many networks and sources at many different times during the day. Some transactions are posted to your account throughout the day, but others can’t be posted until late in the day or very early the next morning when we run our processing. Only you know which checks you wrote or payments you authorized before they get to us, so the best way to stay on top of your correct balance is to continue keeping track of all your transactions.

Answer: No. 24-Hour Grace is not an overdraft service that lets you spend more money than you have. Instead, it's a service that gives you more time to make a deposit to avoid overdraft fees and have your possible returns paid.

Answer: Overdrafts Only

If your account is overdrawn, make a deposit or transfer that brings your account balance positive (or to at least -$50), including new transactions from that day (such as debit card transactions, written checks, and scheduled automatic payments), and we’ll waive overdraft fees.

Example:Let’s say you start the day with $50 in your account and spend $150 at the grocery store, your account balance is now -$100. With 24-Hour Grace, we give you until midnight Central Time on the next business day to make a deposit or transfer and avoid overdraft fees.

Make a deposit or transfer that brings your account balance positive, including new transactions that are being processed that day, and we’ll waive the overdraft fees. In this example, making a deposit of at least $50 would be enough to waive the overdraft fees ($150 grocery bill - $50 already in your account - $50 cushion ¶).

Eligible Returns OnlyIf your account has returns eligible for 24-Hour Grace (but is not overdrawn), and you make a deposit that covers the total amount of possible return transactions plus any new transactions from that day (such as debit card transactions, written checks, and scheduled automatic payments), we’ll pay the possible return transactions. If a sufficient deposit is not made, the transactions will be returned unpaid.

Example:You have $60 in your account when your $1,500 mortgage and $100 electric bill are scheduled to auto-pay that day. If we decide not to pay those into overdraft, we’ll give you more time to make a deposit and have your transactions paid with 24-Hour Grace.

Make a deposit or transfer that covers the total amount of your possible return transactions, plus any new transactions that are being processed that day, and we’ll pay your transactions. In this example, a deposit of at least $1,490 ($1,500 mortgage + $100 electric bill - $60 account balance- $50 cushion ¶) would be enough to pay your transactions. Any deposit less than $1,490 would result in both the mortgage and electric bill being returned unpaid even if the deposit was enough to cover one transaction or the other.

Overdrafts & Eligible ReturnsIf your account is overdrawn and has eligible returns, make a deposit or transfer that brings your account balance positive (or to at least -$50), including new transactions from that day (such as debit card transactions, written checks, and scheduled automatic payments) plus the total amount of possible return transactions, and we’ll waive overdraft fees and pay the possible return transactions.

If your deposit is enough to bring your account balance positive (or to at least -$50) but not enough to cover the total amount of possible return transactions, we’ll waive the overdraft fees but your possible return transactions will be returned unpaid and you may incur merchant fees.

Example:Let’s say you have $60 in your account when you spend $200 on groceries with your debit card. That same day, the $700 check you wrote to cover rent is being processed. With 24-Hour Grace, we’ll give you more time to make a deposit, avoid overdraft fees, and have your transactions paid (if we decide not to pay your rent into overdraft).

Make a deposit or transfer that brings your account balance positive, including new transactions that are being processed that day, plus the total amount of your possible return transactions, and we’ll waive the overdraft fees and pay your rent. In this example, a deposit of at least $790 ($700 rent + $200 groceries - $60 account balance - $50 cushion ¶) would be enough to waive all overdraft fees and pay your rent. A deposit less than $790 but enough to bring your account balance above -$50 would waive the overdraft fees, but your rent would be returned unpaid. A deposit of less than $90 would result in overdraft fees charged and your rent would be returned unpaid.

Answer: You have until before midnight the next business day after your account is overdrawn. A deposit at a Huntington branch needs to be made before branch closing time on the next business day. A deposit, or transfer at an ATM, through online or mobile banking or through our telephone banking service needs to be made before midnight that next business day.

Answer: Acceptable forms of payments include cash or valid check. You can also transfer funds electronically at an ATM, or through our online, mobile, or telephone banking services. Qualifying customers can also access their Standby Cash credit line for help while they're in the 24-Hour Grace window. If you believe you're going to overdraw your account, you can use Standby Cash and make a transfer to prevent the overdraft from occurring †.

Answer: You don’t have to deposit an extra amount to cover the overdraft fees for overdrafts from the prior day. We’ll waive those fees as long as you bring your balance positive (including today’s transactions) and cover the total amount of the possible returned transactions.

Answer: You can make a deposit or transfer at one of our ATMs or branches, or you can make a transfer through our mobile, online, or telephone banking services. For example, a deposit of cash or a check at a Huntington ATM at 11:30 p.m. CT will count, or an online transfer at 11:30 p.m. CT will count.

Answer: No. You should always use an ATM to make an afterhours deposit at a branch. You should not use a night depository or drop box, but if you do, that deposit will be credited to your account no earlier than the business day after the day of deposit and will not meet the 24-Hour Grace deadline.

Answer: Unfortunately, if we receive the deposit on midnight Central Time on the next business day or after, your account is considered overdrawn and it will be too late for 24-Hour Grace to work. The deposit must be made before midnight Central Time (or before branch closing time if made at a branch).

Answer: While access to certain deposits may be delayed due to holds or our funds availability policy, this will most likely impact payment of your possible return transaction. However, we will still waive the overdraft fees if your deposit is sufficient for 24-Hour Grace.

Answer: Business days are Monday through Friday. Saturdays, Sundays, and federal banking holidays are not business days even if our banking offices, ATMs, website, or other services are open or available for use on those days. So, for example, if the overdraft occurs on Friday, you have until before midnight Central Time on Monday (the next business day) to fix the problem. If that Monday is a federal holiday, you have until before midnight Central Time on Tuesday. If you want to make a deposit at a branch, it needs to be before branch closing time.

Answer: The best way to protect yourself from overdraft fees and returns is to know your balance and be sure you don’t spend money you don’t have. Here are three more things you can do:

- Talk to a Huntington Banker about overdraft options for your debit card, ATM transactions, checks, and electronic (ACH) transactions.

- Sign up for Overdraft Protection and link a savings account to your checking account. So, if you spend more money than you have in your checking account, we’ll automatically transfer money from your savings to cover the difference—for free.

- Understand the suite of tools and services Huntington offers to help you avoid overdraft fees and returns. Tools like Huntington Heads Up account alerts§ and Standby Cash. If you are enrolled in Standby Cash, you can access your Standby Cash credit line for help. If you believe you’re going to overdraw your account, you can use Standby Cash and make a transfer to prevent the overdraft from occurring.†

Answer: We will not authorize and pay overdrafts for your consumer ATM and debit card transactions unless you ask us to (opt in). Sometimes these transactions will still cause overdrafts even if you opt out. If that happens, you won't be charged any overdraft fees. You can change your overdraft options at any time. If you want to get more information on our overdraft options for ATM and Debit Card transactions or to change your election, log in to online banking, click Profile at the top and then Overdraft Options. Call us at (800) 445-3658, 24 hours a day, 7 days a week, or visit any Huntington branch to speak with a banker.

Contact Us

Automated Assistant

Quick answers when you need them

Speak with Us

We are here to help

Find a Branch

Find your nearest Huntington Branch

† Standby Cash is subject to terms and conditions and other account agreements. A cash advance fee equal to 5% of the amount of the cash advance will be collected from your Eligible Deposit Account immediately after the cash advance is deposited in that account. A 1% monthly interest charge (12% Annual Percentage Rate) will be added to outstanding balances if automatic payments are not scheduled. Available through online banking or the Huntington Mobile app to individuals with an active Huntington consumer checking account with at least three months of consistent deposit activity of $1,000 or more, and an average daily balance of $200 or more over the last 30 days. An active or recent bankruptcy or other legal process may disqualify you. Other eligibility requirements apply, including your recent overdraft and/or return history, regardless of whether you are charged overdraft fees or have transactions returned or they are waived with our 24-Hour Grace® and $50 Safety Zone® services. We reserve the right to change eligibility criteria at any time. Line amount and/or ongoing availability may vary based on changes to your deposit activity, average daily balance, and number and length of overdrafts and/or returns on any of your Huntington deposit accounts. When any of your Huntington deposit accounts are in an overdraft status for more than one day, your Standby Cash line will be suspended until they are no longer negative. If 90% or more of the approved credit line is drawn three months in a row, Standby Cash will be suspended until it’s paid to a zero balance. Business checking accounts are not eligible for Standby Cash.

##Your account will be automatically closed if it remains negative in any amount for 60 days. including if your account is overdrawn within our $50 Safety Zone.

§Message and data rates may apply.

¶We will not charge an overdraft fee if you make a deposit that brings your account balance positive or to at least -$50.

ⱢThe bank systematically evaluates your ability to overdraft based on a variety of factors such as tenure, deposit frequency, overdraft history, bankruptcy history, etc.

24-Hour Grace®, Huntington Heads Up®, Standby Cash®, and $50 Safety Zone® are federally registered service marks of Huntington Bancshares Incorporated. The 24-Hour Grace® system and method is patented. U.S. Pat No. 8,364,581, 8,781,955, 10,475,118, and others pending.