Savings Goal Getter℠

Make real savings progress with the right tools from Huntington.

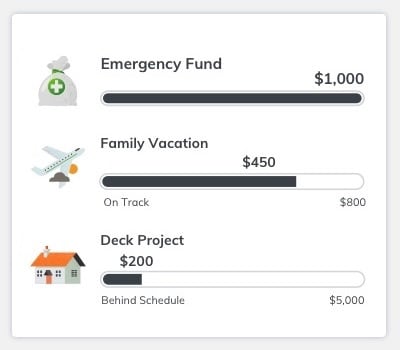

You can add up to 10 Savings Goals plus an Emergency Fund for each of your Huntington Savings and Money Market accounts.

To create a savings goal in The Hub, select a category, and give your goal a name. Enter how much you want to save and by when.

We'll help you calculate easy amounts to save on a weekly or monthly basis and show you how the money you’ve saved is stacking up against your goals.

As you add money to your savings goal, we'll send you Heads Up alerts+ so you can track your savings progress.

Create an Emergency Fund

Save Automatically†

Stay on Track

Learn about Huntington Heads Up®

Message and data rates may apply.

Already a Huntington customer?

Money management – made simple.

Plan ahead for a financial emergency.

Frequently Asked Questions

Answer: Savings Goal Getter℠ helps you visualize a Savings Goal - or more than one - by giving it a name, amount and due date to reach it. It's designed to help you put money aside for an Emergency Fund and other specific Savings Goals.

Answer: You can add Savings Goals to all your Huntington personal savings and money market accounts. You can add up to ten Saving Goals and one Emergency Fund to each account.

Answer: Once you've created your goals, we'll assign money in your savings or money market account towards each goal depending on the goal amount and the date you want to reach it. To add money toward your goals, simply deposit money into your savings or money market account - or transfer from checking - and we'll automatically assign it toward your goals to keep you on track.

Answer: Not at this time.

Answer: Since money is assigned to your Savings Goals based on due dates, you can change the amount of money in each goal by editing the due dates. Remember, money will always be assigned first to an Emergency Fund (if you’ve created one) and then the Savings Goal with the nearest due date.

Answer: Once you’ve reached a Savings Goal (congratulations!), we recommend deleting it. At this time, you can’t view deleted Savings Goals.

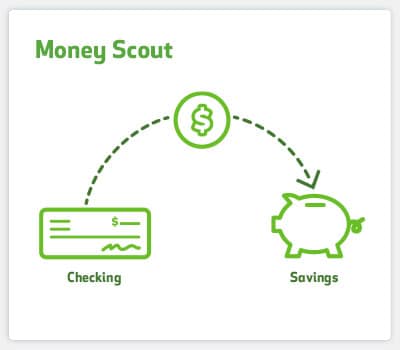

Answer: Yes! Setting up automatic transfers from your checking account to your savings or money market account is an easy way to help you reach your savings goals. Remember, you'll need to set up automatic transfers inside your checking account. Learn how at huntington.com/Automatic-Savings.

Answer: You earn interest on the money in your savings or money market account, whether or not you have created a Savings Goal. The Savings Goal itself does not earn interest.

Answer: You can add or change a Savings Goal as often as you like. To create a goal, click Add a Savings Goal, then give it a name, amount and due date. To edit a goal, click Edit next to an individual goal. Remember, changing the amount or due date will change how much and/or how often you need to deposit or transfer money to reach that goal.

Answer: On the Savings Goal Getter page, click Edit next to a goal and type in a new amount.

Answer: When you create a Savings Goal, you can give it a name, such as “Vacation” or “New Bike.” To change the name, go to the Savings Goal GetterSM page and click Edit next to the goal.

Answer: To delete a goal, click Edit next to the goal, then click Delete next to the trash can icon. Remember, if you delete a savings goal, your progress toward other goals for that account will adjust automatically.

Answer: To see all your goals, click the Manage Savings Goals button on The Hub main page.

Answer: On the Savings Goal Getter℠ page, if you have created an Emergency Fund, that will be displayed first. Additional goals will be listed in the order of nearest due date, whether they are complete or in progress. If more than one goal has the same due date, they will be listed in the order of largest percent complete first. If more than one goal has the same due date and the same percent complete, they will be listed in order of the newest goal first.

Answer: On The Hub main page, you will see up to three goals in online banking, and one goal in the mobile app. If you have set up an Emergency Fund, that will be displayed first. Additional goals will be listed in the order of nearest due date. If more than one goal has the same due date, they will be listed in the order of largest percent complete first. If all goals have been reached, they will listed be in the order of most recently completed.

Answer: When you are logged into your account on huntington.com, up to three Savings Goals are shown on The Hub main page. When you log into the Huntington Mobile app, one goal will be listed. To see all your goals, click the Manage Savings Goals button.

Answer: A good rule of thumb is to have at least 3 months of living expenses available for emergencies.

Answer: While you can't change the rules that determine which goals show up on The Hub main page, you can change elements of a goal that would make it display there. For instance, if you set up an Emergency Fund, that will automatically display on The Hub main page in both online banking and the mobile app. If you change a goal's due date to be sooner than other, that goal will display next after the Emergency Fund.

Answer: You can create up to ten Savings Goals for each savings and money market account you have. To create or view goals for a specific account, simply select it from the Select Account drop-down on the Savings Goal Getter page and click Apply.

Answer: If your savings account is used for overdraft protection, money is transferred from your savings account to your checking account to cover the overdraft. When money is withdrawn, for any reason, from the account linked to a Savings Goal, it reduces the amount saved towards your Savings Goal and may take you off-track. If you overdraft your account, you may incur Overdraft or Return Fees, whether or not your account is linked to a Savings Goal. Learn how you can avoid fees at huntington.com/Overdraft.

Answer: Congratulations! Saving money can be tough but you did it! Once you complete a goal and are ready to use the money, you'll see Edit and Make a Transfer options. We recommend you transfer or withdraw the money from your savings or money market account to use for the goal. Then delete the goal so that other money in your account isn't assigned to the goal you just completed!

Answer: You can assign up to $1 million to each Savings Goal.

Answer: Since every accountholder has their own login information for online banking, they each have the opportunity to use Savings Goal Getter and create their own Savings Goals for the account. Keep in mind, however, that when you log in, you’ll only see the Savings Goals that were created using your login information.

Answer: No. Money is assigned to your Savings Goals from the funds in your Huntington savings or money market account. If you want to assign more money to a Savings Goal, you'll first need to deposit additional money into Huntington savings or money market account, or transfer it from your Huntington checking account.

† Money Scout automatically schedules transfers from your selected checking account and credits your selected savings account. A money market account (MMA) cannot be a selected savings account for use with Money Scout. A scheduled transfer may be canceled before midnight ET on the day it is scheduled. Transfer amounts and frequency may vary and will reduce the money available in your account to cover other transactions. You are responsible for ensuring your account has sufficient funds. You may be charged overdraft fees if your account falls below $0. Subject to eligibility, terms and conditions, and other account agreements.