Frequently asked questions about mobile banking

FAQs

Answer: No, updating your contact information for your alerts1 will not update your account info everywhere else. For example, if you have a mortgage, your mortgage contact information will stay the same.

Answer: Yes, many business checking and savings accounts are eligible for alerts by email, text message, and push notifications1. To sign up for business alerts, log into your Business Online account and click Alerts at the top. Enroll in Alerts and then go to Manage Alerts for the full list of alerts and preferences to receive them.

Answer: Activation codes are not case sensitive.

Answer: Huntington doesn't charge to send you alerts1 but your carrier may charge you data fees. Please contact your mobile carrier for details.

Answer: Yes, you can set time preferences (Do Not Disturb) for when you don’t want alerts delivered by email, text, or push notification. The alert(s) will be sent once the Do Not Disturb time you set is over1. Please note, you will still receive certain critical or time-sensitive alerts during your Do No Disturb time, including 24-Hour Grace®† alerts.

Answer: Once you are enrolled in Huntington online banking, you can download and begin using the Huntington Mobile app. Download the app from the App Store (Apple) or get it on Google Play (Android). Just search for "Huntington Mobile."

Answer: Be sure to check your network connection. If that seems to be working, then check to see if the device is blocked from downloading apps. For example, if you have an iPad issued by your employer, there may be firewalls in place that block you from downloading the app.

Answer: With the exception of certain investment accounts, accounts eligible for online banking will be viewable within the app.

Answer: The Huntington Mobile app supports iPhones and iPads running iOS 10.3 or higher and Android smartphones and tablets running version 5.0 or higher.

Answer: Apple users can go to the App Store to view the available updates. Android users can go to Google Play to view the available updates. If your device is setup for automatic updates, the Huntington Mobile app will be updated automatically.

Answer: Most of the time you will not be required to re-register. However, some security updates made to the Huntington Mobile app to protect customer information will require re-registration.

Answer: For the security of your accounts, your Huntington Username and Password are required in order to access the app. As an added level of security, Huntington also requires you to register your mobile device with us. We call it Mobile Secure Login. Registering your device enables us to tie your specific mobile device to your login credentials, which allows us to identify you with both something you know (your username and password) and something you have (your mobile device).

Answer: Log into huntington.com and update your phone number or email under the My Profile section. (To see the newly provided information in the Huntington Mobile app, you’ll need to log out and then log back in).

Answer: Codes are sent immediately when requested. If you did not receive the code within a few minutes, please ensure your contact information is correct and that you are selecting the correct method. You may then request a new registration code.

Answer:

First, please ensure that the phone number you selected can receive text messages. Second, check the list of our participating carriers to see if your mobile carrier is supported. Lastly, it may be because you or your carrier has blocked messages from short codes. Huntington sends these registration text messages from our short code 446622. Please call your mobile carrier and ask about short code messaging.

Answer: No, the registration code that is sent to you can only be used to register one mobile device. It will expire once you successfully enter it on the registration page (or after 30 minutes if left unused).

Answer: Registration codes expire 30 minutes from the time of your request. If you enter the registration code on the registration page and receive an error message, please verify that you are entering the six-digit number correctly and properly entering your password before trying again. For your security, accounts will be suspended if too many unsuccessful attempts are made.

Answer: You have five attempts to enter the registration code correctly.

Answer: If you received your registration code via email, you’ll be required to answer a security question. This question is one that you set up when you originally registered for online banking. Also, you can manage your list of Security Questions by logging into huntington.com and navigating to the Service Center (under the Customer Service tab). The click Update My Security Questions.

Answer: Strictly for personal security. You may be using a device that isn’t yours, or is shared or public, or is one you don't use often. Please note that when you select to not remember a device, you will be prompted to go through the registration process each time you log in.

Answer: Whenever you change your username, we ask you to re-register your devices. This is to protect the security of your account(s).

Answer: Yes, you can view a list of registered devices within the Settings section of the Huntington Mobile app. Just select the Menu button, then My Settings. To view the list, select Manage Registered Devices. You will also notice the date each device was last used to access your account(s).

Answer: You can delete unrecognized devices by opening the Huntington Mobile app, logging in, then selecting the Menu icon at the bottom of the screen. From there, just tap My Settings and then Manage Registered Devices. To delete a device, tap the Edit button and select the device(s) you wish to delete by tapping the small red circle(s) next to them. Then, tap Delete to unregister the device(s) from your account.

Answer: If you’ve previously registered your device and then deleted and reinstalled the Huntington Mobile app, you may see your device displayed more than once in the list. If you wish, you may remove the device entry used longest ago. Unused devices will be removed after 90 days.

Answer: Occasionally, changes to your device such as operating system upgrades will require you to re-register with Huntington. Also, if you haven’t used your device to access your accounts in 90 days, you may be required to register it again. We ask this of our customers as a security measure.

Answer: This is an added security measure from Huntington. Registration codes are unique to the device from which they are requested.

Answer: Huntington’s Mobile Deposit feature lets you deposit checks from your mobile device, which saves you time by reducing trips to a branch or ATM. (Please note that The Huntington Mobile app supports iPhones and iPads running iOS 14 or higher and Android smartphones and tablets running version 7 (SDK 24) or higher. A minimum 2 megapixel rear facing camera is also required.)

Answer: There’s no fee to use Mobile Deposit. That said, your carrier’s standard data rates may apply.

Answer: Most Huntington checking, savings, and money market accounts that are enrolled in online banking are eligible to use with Huntington Mobile Deposit.

Answer: Eligible checks generally include checks that are in their original form, made payable directly to you, in U.S. Dollars, and drawn against a U.S. Financial institution.

Answer: A few examples of non-eligible checks are: money orders, savings bonds, and travelers’ checks.

Answer: All checks must be signed by the depositor(s). For extra security, you should also include “For Deposit Only – Huntington Bank” beneath the signature as well.

Answer: No, check images are permanently deleted from your device after being sent directly to Huntington.

Answer: Yes, limits may be established on the number of checks and the total dollar amount of checks deposited through Huntington Mobile Deposit. Limits may vary by customer and may change over time. Customers can view their limits from within the app. Tap the Deposits button and follow the instructions.

Answer: Once you’ve submitted your deposit, we recommend writing the date of the deposit on the front of your check along with “Huntington Mobile Deposit.” After the funds have been properly credited to your account, wait 14 days and then destroy the check.

Answer: If you make a deposit on a business day before midnight, we will consider that day to be the day of your deposit. However, if you make a deposit on a non-business day (Saturday, Sunday or Federal holiday), we will consider that deposit as being made on the next business day we are open.

Answer: Funds are generally available within 2 business days after your deposit. However, some exceptions may apply. See our Mobile Deposit Terms for more information.

Answer: Yes, from within the Huntington Mobile app, go to Deposits and then History. A list of all of your mobile deposits from the last 60 days is displayed and images of those checks are available to view as well.

Answer: All deposits are subject to our verification procedures and we may refuse, limit or return deposits for any reason. If there is a change to your deposit amount or status, Huntington will contact you to let you know.

Answer: Make sure that you have placed the check on a dark or contrasting background against so it will stand out. Ensure that all four corners of the check are visible in the picture. Use a steady hand to reduce image blur and take the picture in a properly lit area. If that still doesn’t work, stop by your local Huntington branch and we’ll help you figure it out.

Answer: Mobile Deposit is not currently available to fund a brand new account. Please visit your local branch to make your first deposit.

Answer: Making a mobile deposit doesn't trigger an alert. Click here to view current alerts.

Answer: Yes. To add a new Bill Pay payee, simply tap the plus symbol (+) next to Select a Payee. Also, within the Payments section of the app, you can manage your Bill Pay payees by tapping Payees.

Answer: No. For the time being, you must enroll in Bill Pay through huntington.com.

Answer: Any eligible checking account can be used for bill payments. In the Huntington Mobile app, your eligible accounts are automatically listed on the Payment Summary screen when you tap From.

Answer: Huntington deducts the money from your account on the payment date you specify. Here are the different scenarios that could occur.

- Weekday, before 8:00 p.m. ET: If you make a bill payment and schedule it for the current day, and it's a weekday, before 8:00 p.m. ET, Huntington deducts the money from the funding account right away.

- Weekday, after 8:00 p.m. ET: If you make a bill payment and schedule it for the current day, and it's a weekday, after 8:00 p.m. ET, Huntington deducts the money from the funding account on the morning of the next business day. Business days are Monday through Friday and do not include bank holidays. (So if you make a bill payment on Friday after 8:00 p.m. ET, keep in mind that it won't be processed until Monday morning.)

- Weekend or Holiday: If you make a bill payment and schedule it for the current day, and it’s the weekend or a bank holiday, Huntington deducts the money from the funding account on the morning of the next business day.

- Future Payments: If you schedule a bill payment for a particular day in the future, Huntington will deduct the money from the funding account on the morning of the day on which it is scheduled. If your scheduled date falls on a weekend or bank holiday, then the funds will be deducted on the morning of the next business day.

Answer: Electronic payments should be scheduled at least 2 business days before payment is due. Payments mailed via U.S. Postal Service should be scheduled at least 5 business days before payment is due. You can tell whether a payee receives electronic or mailed payments by noting the icon related to the payee on the “Pay Bills” screen. If the icon is a lightning bolt, the payment will be sent electronically; if the icon is an envelope, a check will be mailed to the payee.

Answer: A Request for Payment is a message from a trusted source requesting payment from you. Before sending a payment in response to a Request for Payment, you should verify that the request relates to a payment you were expecting to make to an individual or business. You should only make payments to trusted individuals and business that you know and can verify.

Answer: Based on the entered search criteria or your current location, the 25 closest branches and ATMs will be returned (provided that Huntington has that many locations within 50 miles).

Answer: Quick Balance provides mobile customers with a more convenient way to view account balance information. With just a single tap on the login page, you can easily access your checking, savings, money market and/or Voice Credit Card® account balances. This is an optional feature and customers must opt-in prior to using the feature. Simply follow the instructions on the login screen of the app.

Answer: Currently, Quick Balance is only available for checking, savings, money market, and Voice Credit Card® accounts.

Answer: Quick Balance uses your username and your registered device to authenticate your account prior to displaying account balances. Therefore, to use the Quick Balance feature, you must first have your phone registered through the device registration process and your username populated (either by typing it in or having it previously saved). Account nickname, masked account number, and current balance are the only information that is displayed for accounts you have enabled for this feature. This information is similar to that displayed for account alerts, ATM receipts, and bank statements. You have the choice as to whether to turn ON this feature both as a global app setting and at an individual account-level setting.

Answer: The first 20 characters of the account nickname that you have provided within online banking along with the last four digits of the account number (the number that Huntington assigned to identify this account) will be displayed on both the login page and the settings page. In the absence of a nickname, this defaults to the first 20 characters of the account type. This name is the same name that is used on the Accounts screen within the app.

Answer: Your current account balance(s) will be displayed formatted as currency, e.g. $500.00.

Answer: We only display the balances for accounts that you have turned on using Quick Balance. To adjust the accounts displayed, simply log into the app. Then tap on Menu in the bottom navigation bar. In My Settings, you have the ability to turn eligible accounts On or Off.

Answer: Your account balance reflects the sum of today's beginning balance plus any pending transactions.

Answer: Today’s beginning balance is the amount in your account after the previous business day's processing. This balance does not consider today's transactions, transactions that post on weekends or holidays, or overdraft lines of credit. Transactions clear Mondays through Fridays except holidays. Example: A transaction that arrived Saturday would be processed Monday and would appear in Tuesday's beginning balance.

Answer: Pending transactions are electronic transactions that will be processed today. There may be other transactions (checks, mobile deposits, etc.) that are not included, but nevertheless will be processed today as well.

Answer: No, the account balance(s) displayed within Quick Balance does not include Overdraft Protection (line of credit).

Answer: If your account is overdrawn, the account balance will display within Quick Balance with a negative sign, e.g. - $20.00.

Answer: You have two courses of action and both are equally secure. You can either change your username at huntington.com, or call us at (800) 480-2265, daily 7:00 a.m. to 7:00 p.m. ET. to have your phone removed from our system. Either action will cause the authentication to fail, and as a result, balances will no longer be displayed pre-login on your lost phone.

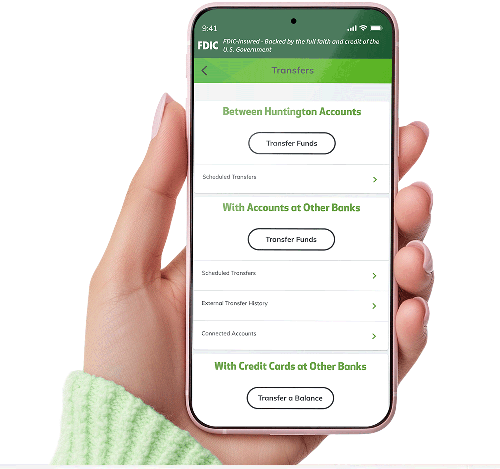

Answer: Yes, you can transfer funds to and from other financial institutions with the Huntington Mobile app. Just open the app and tap the Transfers icon in the bottom. Under Accounts With Other Banks, tap Transfer Funds.

Please note that you must have the external account already set up to be able to view transfer limits. To add a new external account, log into the Huntington Mobile app. Tap the Transfers tab and, under With Accounts at Other Banks, choose Transfer Funds. Click on the "Add a new account" link and complete the required fields.

1Message and data rates may apply. Message frequency depends on user preferences. Please consult your mobile carrier for details.

To opt out of text services, text STOP to 446622. For additional support text HELP to 446622 for or call (800) 480-2265, daily 7:00 a.m. to 7:00 p.m. ET.

View terms and conditions.

Learn more about our Online Guarantee.

Our participating carriers include (but are not limited to): AIO Wireless, Alltel, AT&T, Cablevision USA, Cincinnati Bell, Google Voice™, MetroPCS, Pioneer Wireless US, Pocket Com USA, Simmerty US, SprintPCS, Tier 3 US Carrier GL, T-Mobile®, Tracphone, Union Wireless, U.S. Cellular®, Verizon Wireless, Virgin Mobile USA.

† $50 Safety Zone®. Your account will be automatically closed if it remains negative in any amount for 60 days, including if your account is overdrawn within our $50 Safety Zone. Learn more at huntington.com/SafetyZone and huntington.com/Grace.

Apple, the Apple logo, iPhone® and iPad® are trademarks of Apple Inc., registered in the U.S. and other countries. Apple Pay™ and Touch ID are trademarks of Apple Inc. Google Play™ is a trademark of Google Inc.

Voice Credit Card®, $50 Safety Zone®, and 24-Hour Grace® are federally registered service marks of Huntington Bancshares Incorporated. The 24-Hour Grace® system and method is patented. U.S. Pat No. 8,364,581, 8,781,955, 10,475,118, and others pending.

We are here to help

If you can’t find what you’re looking for, let us know. We’re ready to help in person, online, or on the phone.

Call Us

To speak to a customer service representative, call (800) 480-2265.