Key Takeaways:

- Always date your check and write the payment amount in both numbers and words to help ensure your check is processed correctly.

- Write your checks in blue or black ink and fill in all spaces to help reduce the risk of fraud.

How to Write a Check: Step-by-Step Instructions and Examples

Step 1: Date the check.

Write the date on the line at the top right-hand corner. This step is important so the bank or person you are giving the check to knows when you wrote it.

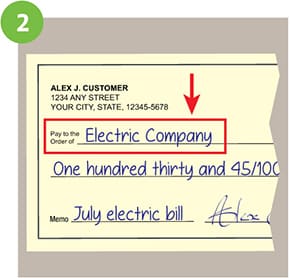

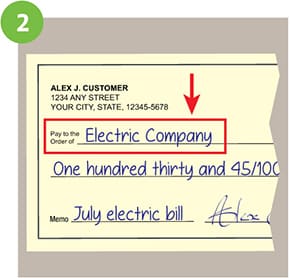

Step 2: Who is this check for?

The next line on the check, "Pay to the order of," is where you write the name of the person or company you want to pay. You can also just write the word "cash" if you don’t know the person or organization’s exact name. Be aware, though, that this can be risky if the check ever gets lost or stolen. Anybody can cash or deposit a check made out to "cash."

Step 3: Write the payment amount in numbers.

There are two spots on a check where you write the amount you are paying. First, you’ll need to write the dollar amount numerically (for example, $130.45) in the small box on the right. Be sure to write this clearly so the accurate amount is processed and subtracted from your bank account.

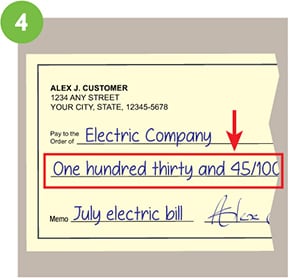

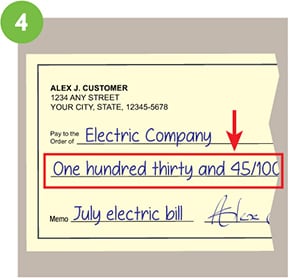

Step 4: Write the payment amount in words.

On the line below "Pay to the order of," write out the dollar amount in words to match the numerical dollar amount you wrote in the box. For example, if you are paying $130.45, you will write "one hundred thirty and 45/100." To write a check with cents, be sure to put the cents amount over 100. If the dollar amount is a round number, still include "and 00/100" for additional clarity. Writing the dollar amount in words is important for a bank to process a check as it confirms the correct payment total.

As you write out the dollar amount, try to make sure you fill the entire section—start on the left where the line begins, and draw a line from the end of your writing to the right-hand side, where the section ends. This can help prevent someone from altering the amount.

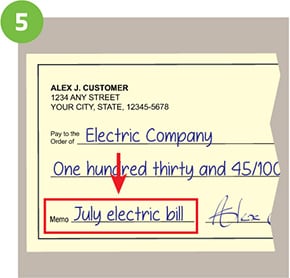

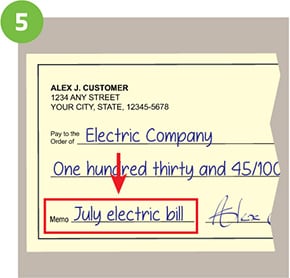

Step 5: Write a memo.

Filling out the line that says "Memo" is optional, but helpful for knowing why you wrote the check. If you are paying a check for a monthly electric bill or rent, you can write "Electric Bill" or "Monthly Rent" in the memo area. Often, when you are paying a bill, the company will ask you to write your account number on the check in the memo area.

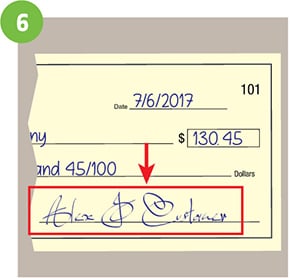

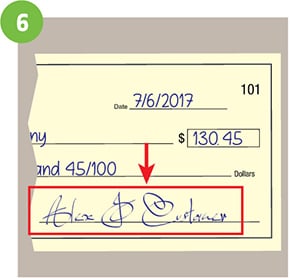

Step 6: Sign the check.

Sign your name on the line at the bottom right-hand corner using the signature you used when you opened the checking account. This shows the bank that you agree that you are paying the stated amount and to the correct payee.

How do you balance a checkbook?

Every time you spend money or make a deposit, you should keep track of this in your checkbook's check register, which can be found with the checks you received from Huntington. Your check register is meant to be used for keeping track of your deposits and expenses. All transactions should be recorded, including checks, ATM withdrawals, debit card payments, and deposits.

Record your transactions.

- If you make a payment by check, you will record the check number, found in the top right corner of the check. This also helps you keep track of your checks, helping you ensure none of your checks are missing, and reminding you when you need to reorder checks.

- Be sure to make note of the date for your records. In the "Transaction" or "Description" column, describe where the payment was made or for what. Then, write down the exact amount in either the withdrawal or deposit column depending on if you spent money or received it.

- Subtract the amount of any checks, withdrawals, payments, and bank fees from the previous transaction, or add the amount of any deposits.

Reconcile your bank statement each month.

When you receive your monthly bank statement, whether it comes in the mail or you view it online, take the time to balance your checking account. First, download our Balancing Worksheet. Then, follow the directions to enter the information from your checkbook register and bank account statement, as well as any unlisted deposits or withdrawals. Once you are finished with the worksheet, if your adjusted checkbook and account balance match, your checking account is balanced.

If there are differences, take the time to check your math, see if there are outstanding checks that might not show on your statement yet, and double-check to ensure you didn’t miss a fee or transaction. If you believe there is an error on your bank statement, contact Huntington as soon as possible.

Balancing your checkbook may feel outdated in light of online banking, mobile banking, and budgeting technology, but there are still benefits to balancing your checkbook each month (or even each week). For example, if you wrote someone a check and they haven’t cashed it yet, that amount won’t be listed in your online history, but it will be in your check register. Having accurate knowledge of payments you have made can help you avoid overdraft fees and returns. Additionally, keeping a second record of your transactions could help you spot potential instances of fraud.

How do I reorder checks?

All out of checks? No problem! With Huntington, you can easily order checks online, through the Huntington Mobile app, by calling us at (800)480-2265, or by placing an order at a Huntington branch.

How to Write a Check FAQs

How do you write a check with cents?

To write a check with cents, put the cents amount over 100. For example, if you are paying $236.79, write out "two hundred thirty-six and 79/100." Even if the check amount is a round number, like $5,250.00, include "00/100" for additional clarity, writing it as "five thousand two hundred fifty and 00/100."

How do I correct a mistake on a check?

If you make a mistake when writing a check, like misspelling a name or writing the wrong dollar amount, you can void the check, indicating it shouldn’t be used for payment.

How do I void a check?

To void a check, you can either write VOID in big letters across the entire face of the check, or write VOID in the date line, payee line, amount box, amount line, and signature line. Use a blue or black pen so the writing is clear and permanent.

After you void the check, record the voided check number in your checkbook. This will help you remember that the check was voided and you’re not waiting for it to clear your account. If that check number is posted to your account, contact your bank right away. Finally, if you use duplicate checks, make sure your VOID marks are seen on the duplicate, too.

Do checks expire?

Personal checks usually expire if they aren’t cashed within six months (180 days).

How do I endorse a check to someone else?

To endorse a check to someone else, sign your name on the back of the check in the top section that reads "Endorse Check Here." Below your signature, write "Pay to the order of" and the person’s name you want to sign the check over to. This signals to the bank that you are endorsing the transfer of ownership for the check.

How do I deposit a check?

You can usually deposit checks through your bank’s mobile app or by visiting your bank’s nearest branch. At Huntington, you can deposit a check through the Huntington Mobile app, a Huntington ATM, or at a Huntington branch.

To deposit a check through the Huntington Mobile app, log into the app, select Deposit, choose the account you’d like the check to be deposited in, and enter the dollar amount. Take a photo of the front and back of your endorsed check, and submit the deposit.

To deposit a check at a branch, make sure you bring a valid form of ID, like a driver’s license or passport. Once you arrive at the branch, sign the back of the check to endorse it, and present the check to a banker. The banker can help deposit the check into your account or give you cash.

Can I write a check with pencil?

Never write a check in pencil—pencil is easy to erase. If the check falls into the wrong hands, a person could alter the amount on the check or change the intended recipient. To help protect yourself from potential fraud, use black or blue ink to write your checks.

Can I write one check to two people?

Yes, you can usually make a check out to multiple people—this is generally seen when giving a check as a wedding gift. If you’re writing a check to more than one person, be sure to add "and" or "or" in the "Pay to the order of" line. If the check is made out to "John and Jane Smith," then John and Jane must both endorse the check, and if the check is made out to "John or Jane Smith," then John OR Jane can endorse the check.